Table of Content

Apart from these, employment status, monthly income, property details and loan-to-value ratio also affect home loan eligibility. The property ownership remains with the lender till the home loan repayment is complete, including interest. Check your CIBIL score and try and optimise it, so you can avail of the best possible terms. Make sure you repay your EMIs on time and close any other loans, where possible, to showcase a higher repayment capacity. Apart from this, lenders also assess eligibility based on your age and city of residence.

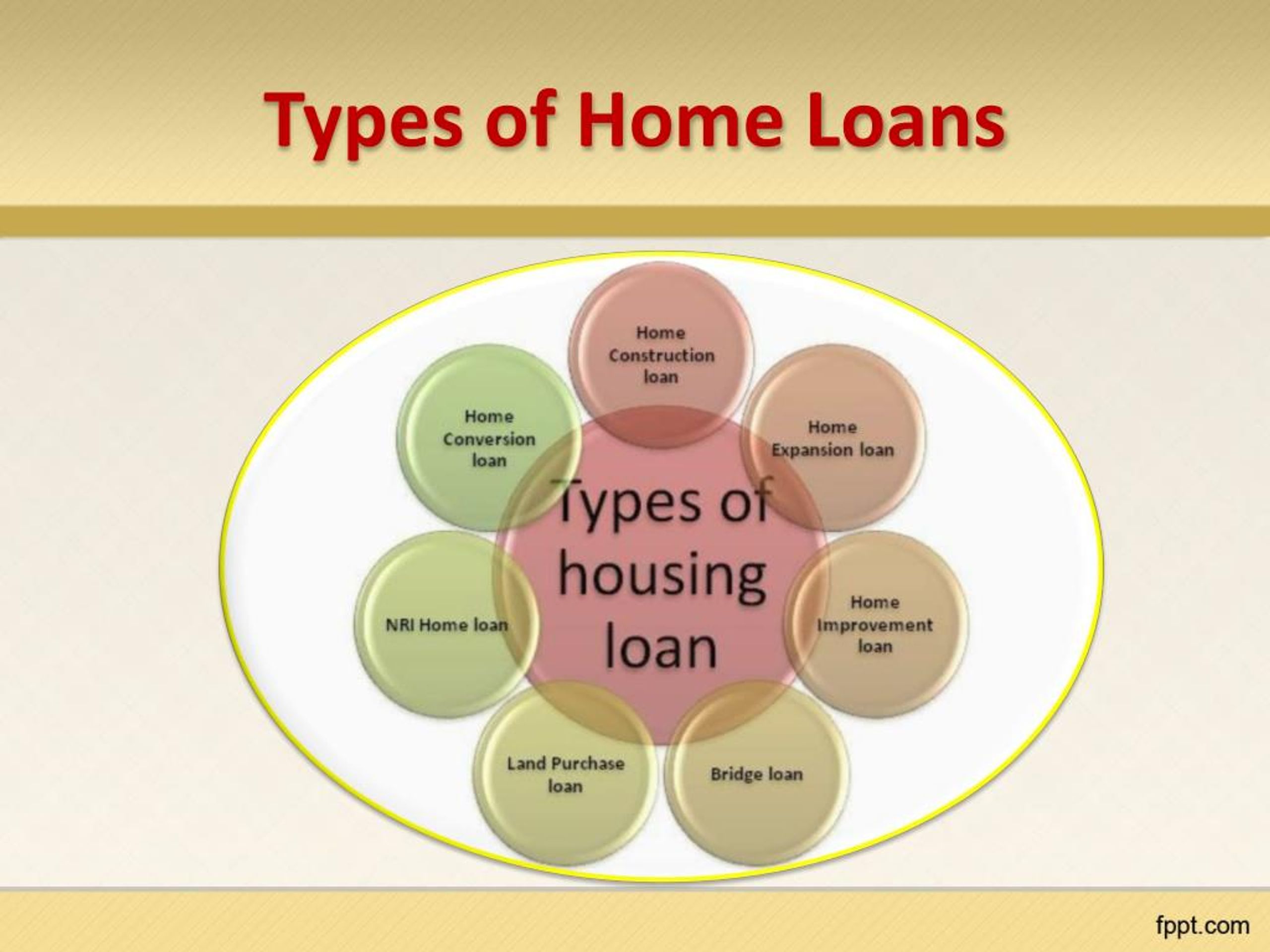

For those who don’t cut with their profile alone, a viable alternative is opting for a joint home loan. A co-signer is required to step in only when the primary borrower defaults on loan repayment. A Home Loan is a secured loan under which you borrow a sum to purchase or renovate a residential or commercial property. You borrow the amount at a predetermined interest rate for a given period of time and repay the sum with interest through EMIs. You can use our Home Loan Eligibility Calculator to better understand your home loan eligibility based on salary.

What is a Repo Rate linked Home Loan?

A home loan is secured in nature, i.e., the loan amount is sanctioned against a collateral, which is the property in question. If you’re wondering how to apply for a Home Loan, the below guide will walk you through our easy Home Loan application process. If you wish to avail of a Loan Against Property as a solution for your funding needs, consider borrowing from Bajaj Housing Finance for competitive terms and policies. Once approved, get access to the entire sanction in an account of your choosing without a long wait, allowing you to use the funding as soon as you would like. With Bajaj Finserv, access this online calculator whenever you need from anywhere and use it for free.

One can access all their loan account details and related documents through the Bajaj Housing Finance Customer Portal, without any external dependency. While you can apply offline, it is a lot quicker to fill the easy online application form and apply online. Availtax benefits on your under construction property up to Rs. 3.5 lakh annually on loan payments.

Application Forms

The calculator displays the maximum loan amount you can borrow from Bajaj Finserv instantly. Lenders will consider your take-home salary, minus certain common deductions such as gratuity, PF, ESI, etc. The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow.

Before you apply for Housing Loan, it is important you are aware of the Home Loan eligibility criteria set by your lender. Knowing the criteria in advance and ensuring you meet the most critical ones are critical to enhancing your chances of approval. Applicants should evaluate their Loan Against Property eligibility before applying for the loan to maximise their gains and savings from the credit facility. However, having a bad credit score is not the end of one’s Home Loan borrowing journey.

Pocket Insurance

Yes, you can switch from a floating rate of interest to a fixed rate during the repayment tenor of your housing loan. You need to pay a nominal amount as a conversion fee to your lender for switching. The exact minimum salary required for an online Home Loan can vary as per the location.

Housing Loan processing fees refer to the main fee charged with every loan application. It is the amount the lender charges to process your application and extend funding. We charge a processing fee starting from 0.25% to 7.00% of the loan amount.

Will I be eligible for a Home Loan if I have a bad credit score?

Applicants who want to get a Home Loan must submit a list of supporting documents. These documents contain personal, financial, employment, and property information, which varies depending on the type of employment. You start paying your home loan EMI when the disbursement cheque is created.

We offer a flexible repayment tenor to ensure your EMIs remain affordable and don’t stretch your finances too thin. The loan amount one can avail of remains uncapped for eligible applicants with a good credit history and steady income, among other factors. It is important to check the Home Loan eligibility criteria, so you can maximize your chances of approval. Home loan borrowers who are individuals with a floating interest rate can prepay parts of their home loan or foreclose the entire sum without any additional fees or penalty. There is no restriction on the use of funds availed of from Bajaj Housing Finance under its property loan segment. Co-applicants who are co-owners can avail of tax benefits mentioned under the Income Tax Act.

FOIR contributes to the overall housing loan eligibility and a lower FOIR can enhance your chances for a quicker sanction. The repayment of existing loans enhances your chances of Home Loan approval. This is because paying off debts reduces your total liability, thereby increasing your capacity to repay. For instance, repaying any outstanding liability on vehicle or personal loans improves Home Loan eligibility. Check your loan eligibility with an eligibility calculator to confirm increased repayment capacity.

Prospective borrowers should be able to showcase a minimum of Rs.30,000 as their monthly income to be considered for a Housing Loan. The minimum salary for personal loans that you need to be earning will depend on your city of residence. The minimum salary that you need to be earning is Rs. 22,000, but that depends on your city.

No comments:

Post a Comment